Earn 100,000 Membership Rewards® Points after spending $15,000 on eligible purchases in the first 3 months.

APPLY NOW

Points can be redeemed for up to $1,000 in travel, gift cards, or statement credits.

The American Express Business Gold Card is designed for business owners seeking to maximize rewards in their highest spending categories while enjoying robust benefits tailored to their needs. With customizable earning potential, a generous welcome bonus, and features that enhance flexibility, this card is a standout choice for businesses looking to combine earning potential with premium perks.

Key Features of the Business Gold Card

1. Earn Rewards Faster with 4X Points

- Earn 4X Membership Rewards® Points on your top two spending categories per billing cycle, chosen automatically from these eligible categories:

- U.S. media advertising (online, TV, radio)

- U.S. restaurants, including takeout and delivery

- U.S. gas stations

- U.S. electronic goods, software, and cloud providers

- Monthly wireless phone services from U.S. providers

- Transit expenses (rideshare, tolls, parking, trains, and buses)

- The 4X points apply to the first $150,000 in combined purchases from these categories annually; after that, earn 1X points.

2. Welcome Bonus: 100,000 Points

- Earn 100,000 Membership Rewards® Points after spending $15,000 on eligible purchases in the first 3 months.

- Points can be redeemed for up to $1,000 in travel, gift cards, or statement credits.

3. Flexible Redemption Options

- Redeem points for travel, statement credits, gift cards, or merchandise.

- Book flights and prepaid hotels through AmexTravel.com and earn 3X Membership Rewards® Points.

4. Business Benefits

- $240 Flexible Business Credit: Receive $20 in monthly statement credits for purchases at FedEx, Grubhub, and office supply stores.

- $155 Walmart+ Credit: Pay for your Walmart+ monthly membership using the card and receive a credit of up to $12.95 each month.

- Expense Management Tools: Includes year-end summaries, QuickBooks® integration, and vendor payment solutions through Bill.com.

5. Premium Travel Perks

- No Foreign Transaction Fees: Shop abroad without incurring extra charges.

- Access to The Hotel Collection: Enjoy a $100 property credit and room upgrades at select properties when booking a stay of two nights or more.

- Travel Protections:

- Trip Delay Insurance: Reimbursement for delays over 12 hours.

- Baggage Insurance Plan: Coverage for lost or damaged luggage.

- Car Rental Loss and Damage Insurance: Secondary coverage for rental vehicles.

- Cell Phone Protection: Coverage up to $800 per claim with a $50 deductible (two claims per year).

6. Payment Flexibility

- Pay Over Time: Carry a balance with interest on eligible charges.

- No Preset Spending Limit: Spending power adjusts based on purchase, payment, and credit history.

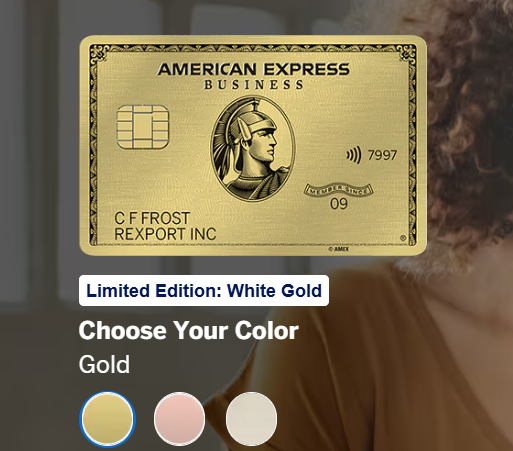

7. Exclusive Design Options

- Choose from Gold, Rose Gold, or the limited edition White Gold card design.

Pros and Cons of the Business Gold Card

Pros

- High-Earning Potential: 4X points on your top spending categories adapt to your business needs.

- Generous Welcome Bonus: 100,000 Membership Rewards® Points with achievable spending requirements.

- Business-Centric Credits: $240 in credits for business purchases and Walmart+ subscription reimbursements.

- Comprehensive Travel Protections: Includes no foreign transaction fees, trip delay insurance, and baggage insurance.

- Customizable Design: Aesthetic options to suit your style.

Cons

- High Annual Fee: $375, which may deter businesses with smaller budgets.

- Spending Threshold for Bonus: Requires $15,000 in spending within 3 months, which might be steep for some small businesses.

- Points Cap: 4X points limited to $150,000 in combined category purchases annually.

Who Should Get the Business Gold Card?

This card is ideal for:

- High-Spending Businesses: Companies with significant expenses in the card’s eligible categories.

- Frequent Travelers: Businesses that benefit from 3X points on travel and robust travel protections.

- Tech-Savvy Operations: Those using QuickBooks® and Bill.com to streamline expenses.

- Businesses Seeking Premium Rewards: Those looking to maximize the value of Membership Rewards® Points through travel redemptions.

How It Compares to Other Business Cards

| Card Name | Best For | Annual Fee | Rewards Structure |

|---|---|---|---|

| Amex Business Gold | Customizable rewards | $375 | 4X on top 2 categories; 3X on Amex Travel |

| Amex Business Platinum | Premium travel perks | $695 | 5X on flights/hotels booked via AmexTravel.com |

| Chase Ink Business Preferred | High-value points | $95 | 3X on travel, shipping, and business categories |

| Capital One Spark 2X Miles | Simplicity and flat rewards | $95 (waived 1st yr) | 2X miles on all purchases; 5X on hotels/cars |

The Amex Business Gold Card excels for businesses with fluctuating spending patterns, thanks to its adaptive rewards structure. While it has a higher annual fee than some alternatives, the targeted earning potential and premium benefits make it worthwhile for high-spending businesses.

How to Maximize Your Business Gold Card

- Utilize the 4X Categories:

- Focus spending in high-earning categories like advertising, restaurants, or gas stations to maximize rewards.

- Take Advantage of Business Credits:

- Use the $20 monthly credits at FedEx, Grubhub, and office supply stores to offset costs.

- Book Travel Smartly:

- Earn 3X points by booking flights and prepaid hotels through AmexTravel.com.

- Add Employee Cards:

- Track spending, set limits, and earn additional points on employee purchases.

- Redeem Points Strategically:

- Maximize value by redeeming points for travel through AmexTravel.com or transferring to partner programs.

Final Thoughts

The American Express Business Gold Card is a robust choice for businesses looking for customizable rewards, premium travel benefits, and tools to manage expenses efficiently. While the $375 annual fee is on the higher side, businesses that can leverage the 4X categories and included credits will find this card provides exceptional value.

Discover more from Fly, Card, Point

Subscribe to get the latest posts sent to your email.